What the 3,000 direct deposit alert means

Starting in 2026 the IRS will increase monitoring and consumer notifications for larger direct deposits. A “3,000 direct deposit alert” refers to notices taxpayers may see when a single IRS-related deposit of $3,000 or more posts to their account.

This alert does not automatically mean tax liability changes, but it is a prompt to confirm the deposit, check your tax records, and protect against fraud.

Why the IRS is sending more direct deposit alerts

The IRS is focusing on clearer communication and fraud prevention. Larger deposits attract attention from criminals and can cause confusion for recipients.

Alerts help taxpayers verify legitimate refunds, credits, or payments and reduce the number of returns or inquiries the IRS must handle later.

Common reasons for a $3,000 or larger IRS deposit

- Refund from an amended or original tax return.

- Advanced or adjusted tax credits paid by the IRS.

- One-time relief payments or special credits in certain years.

- Corrective payments after an IRS processing update.

Practical steps if you get a 3,000 direct deposit alert

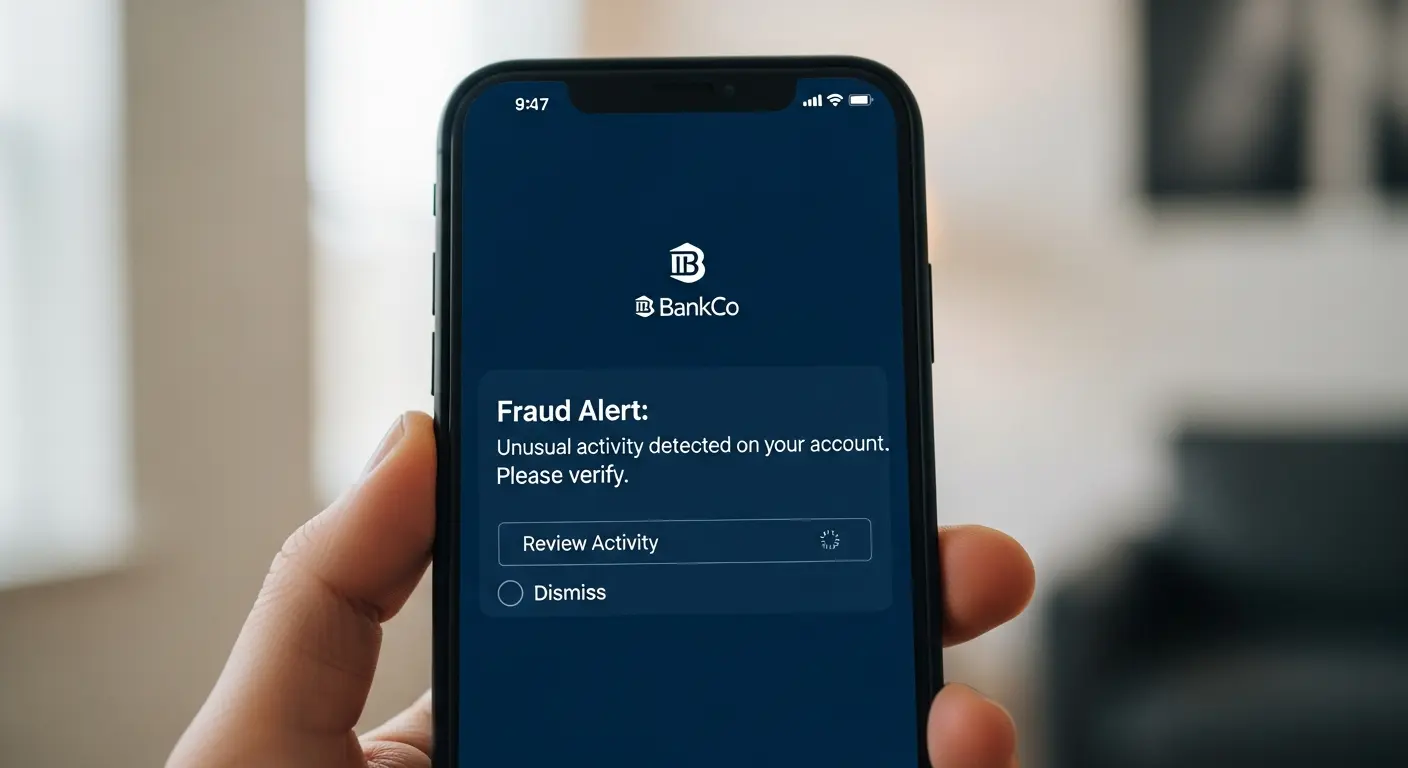

Follow these clear actions to verify and secure the deposit. Quick steps reduce stress and stop fraud.

- Pause before acting. Do not click links in text messages or emails that claim to be from the IRS.

- Check your bank account directly using your bank’s official app or website.

- Log in to your IRS account at irs.gov to verify payments and records.

- Compare the deposit amount and date with any expected refund or credit.

- If unsure, call the IRS or your bank using phone numbers from official websites or statements.

How to confirm a legitimate IRS deposit

Verification is straightforward. Use official channels only and keep records of what you find.

- Sign in to your bank account to see the posting details and trace number.

- Visit the IRS “Where’s My Refund?” or your IRS online account to match amounts and payment references.

- Check prior tax filings, notices, or correspondence that mention adjustments or credits.

- Keep screenshots and save emails that relate to the payment for your records.

How to update direct deposit information before 2026 changes

If you expect refunds or credits, now is a good time to confirm the deposit routing and account number the IRS has on file.

Update your bank account information when filing a return or through the IRS account portal to avoid delays or misdirected payments.

Checklist to prepare

- Confirm routing and account numbers with your bank.

- Use secure methods when giving direct deposit info (no public Wi-Fi).

- Consider using a checking account dedicated to government payments to make tracking easier.

- Enable bank notifications for deposits to spot large payments immediately.

What to do if the alert is unexpected or looks like a scam

Scammers mimic government alerts. Treat unexpected messages with caution and verify using independent sources.

If you suspect fraud, report it to the IRS and your bank. Do not provide personal information to callers or web forms you do not trust.

Reporting steps

- Forward suspicious IRS-related emails to phishing@irs.gov.

- Report phone scams to the Treasury Inspector General for Tax Administration (TIGTA).

- Contact your bank immediately if funds move or if account details were exposed.

The IRS uses direct deposit for most refunds because it is faster and more secure than checks. Still, criminals sometimes target large deposits with phishing attempts.

Practical example: A small real-world case study

Maria, a freelance graphic designer, received an alert that $3,200 was deposited into her checking account in January 2026. She had not filed an amended return and was unsure why the deposit arrived.

She followed a short verification process: she checked her bank app, logged into her IRS online account, and found a notice stating the payment was an extra earned income credit adjustment. She saved the IRS notice and the bank deposit record in a folder for her tax files.

Because she verified the deposit quickly, Maria avoided a potential phishing email that falsely claimed there was a problem and asked for account numbers.

How the change affects taxpayers and tax professionals

Taxpayers should be more proactive about monitoring accounts and keeping contact information current with the IRS. Tax preparers should inform clients about the new alerts and include verification steps in end-of-year guidance.

Businesses that handle payroll or benefits may also want to alert employees about the possibility of larger government deposits to reduce confusion.

Action items for tax pros

- Include a one-page checklist for clients on how to verify direct deposits.

- Advise clients on bank notification settings and documentation best practices.

- Warn clients about common scam tactics tied to large deposit alerts.

Bottom line

The 3,000 direct deposit alert for 2026 is a reminder to confirm payments through official channels and to protect personal information. A simple verification routine will prevent confusion and reduce exposure to fraud.

Keep records, use official IRS tools, and contact your bank or a tax professional if anything looks wrong. A few careful steps will keep your funds safe.